Prevention of money laundering and fight against financing to terrorism and the proliferation of mass destruction weapons.

Banco de Inversiones S.A. has a Strategy for the Prevention of Money Laundering, the Financing of Terrorism and the Proliferation of Weapons of Mass Destruction. It defines the principles and tasks aimed at the prevention of illegal activities and terrorist acts, the application of the Know Your Customer and Due Diligence Policies. It is designed according to the indications defined in Instruction 26/2013 of the Superintendency of the Central Bank of Cuba, in the National Strategy for the Prevention and Confrontation of Money Laundering and Financing of Terrorism and Resolution 51/2013 "General Rules for the detection and prevention of operations in the fight against money laundering, the financing of terrorism and the movement of illicit capital of the Central Bank of Cuba".

The Bank has an Integral System for the identification of risks that is applied throughout the institution to prevent criminal acts. It defines risks according to their magnitude and are classified as: operational, credit, liquidity, reputational, legal and sovereign. The Internal Control System is applied based on Resolution 60/11 of the General Comptroller of the Republic of Cuba. A constant monitoring of the clients is maintained, checking that they do not appear in the lists of terrorists published by the United Nations. In each organizational unit of the Bank, the responsibilities of the workers have been clearly defined, in order to strength the prevention of suspicious operations that could lead to the occurrence of possible criminal acts of corruption.

Available downloads:

1- What scope and duration does the Bank take into account when requesting large amounts to finance an investment?

R / Banco de Inversiones manages all the requested financing, as well as guarantees the recovery of this in the period required, according to the current approvals.

2- What percentage of interest applied in the financing?

R / Bancoi, as the rest of the Banking System in Cuba, is ruled by current circulars and policies for the application of the interest rates of the financing requested.

3- To whom does the Bank offer the Investment Evaluation service?

R / Bancoi offers this innovative service to legal persons, financial institutions or Cuban companies of any kind, thanks to the work of a multidisciplinary team with experience in the evaluation of investments of various sectors of the national economy.

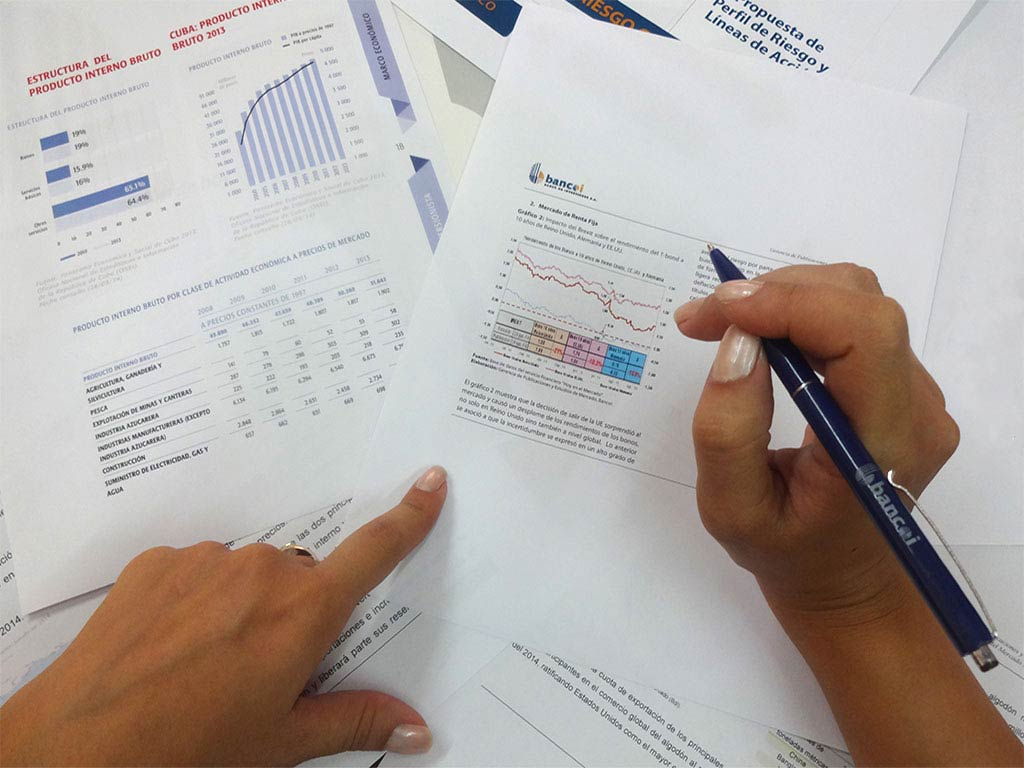

4- How do the services of the Investment Evaluation Management support the development of the country's investment process?

R / Advising the investor in the preparation of the studies, as established in the decrees, resolutions and methodologies in force. Technical, economic, financial and executive schedule analyzes are carried out to identify the correspondence between what was planned and what has actually been executed, which facilitates decision-making for the investor.

5- Does the Bank identify potential partners in businesses with foreign investment?

R / No. Bancoi evaluates the documentation delivered by the Client once he identified the possible partners, facilitating the decision making regarding the definitive partner or partners. In addition, this service constitutes a core point in the prevention of possible money laundering.

6- What documentation must be submitted for the evaluation of partners by the Bank?

R / The documentation to be provided by the Client for the execution of this service is the same as that referred by Law No. 118 Foreign Investment Law.

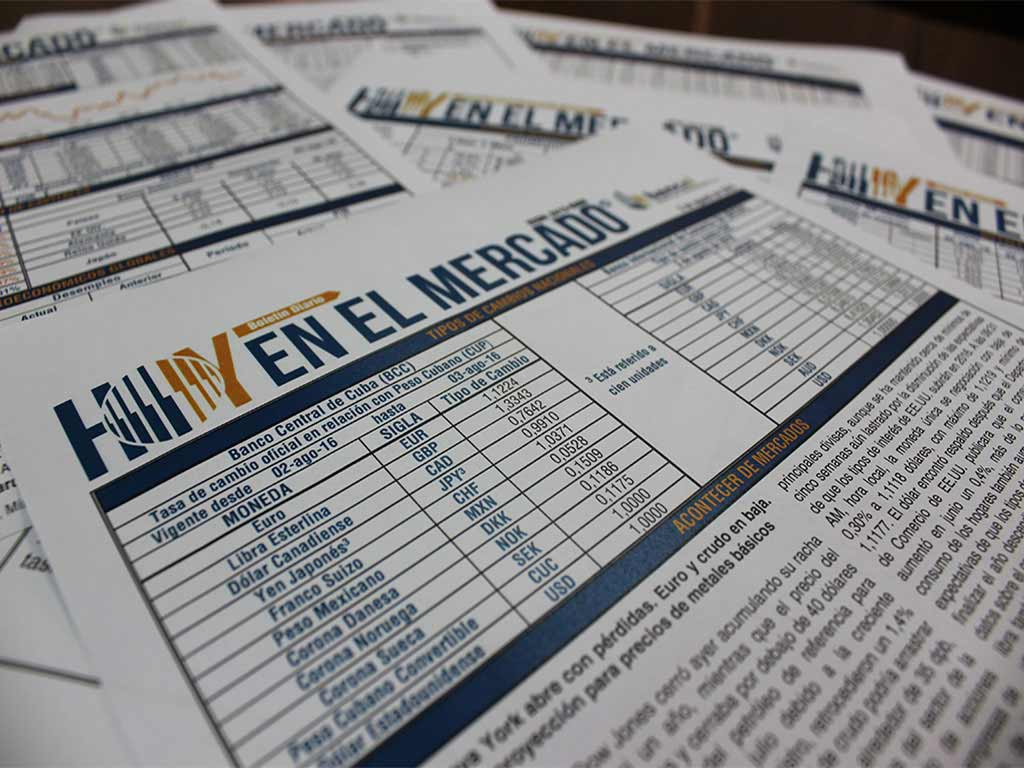

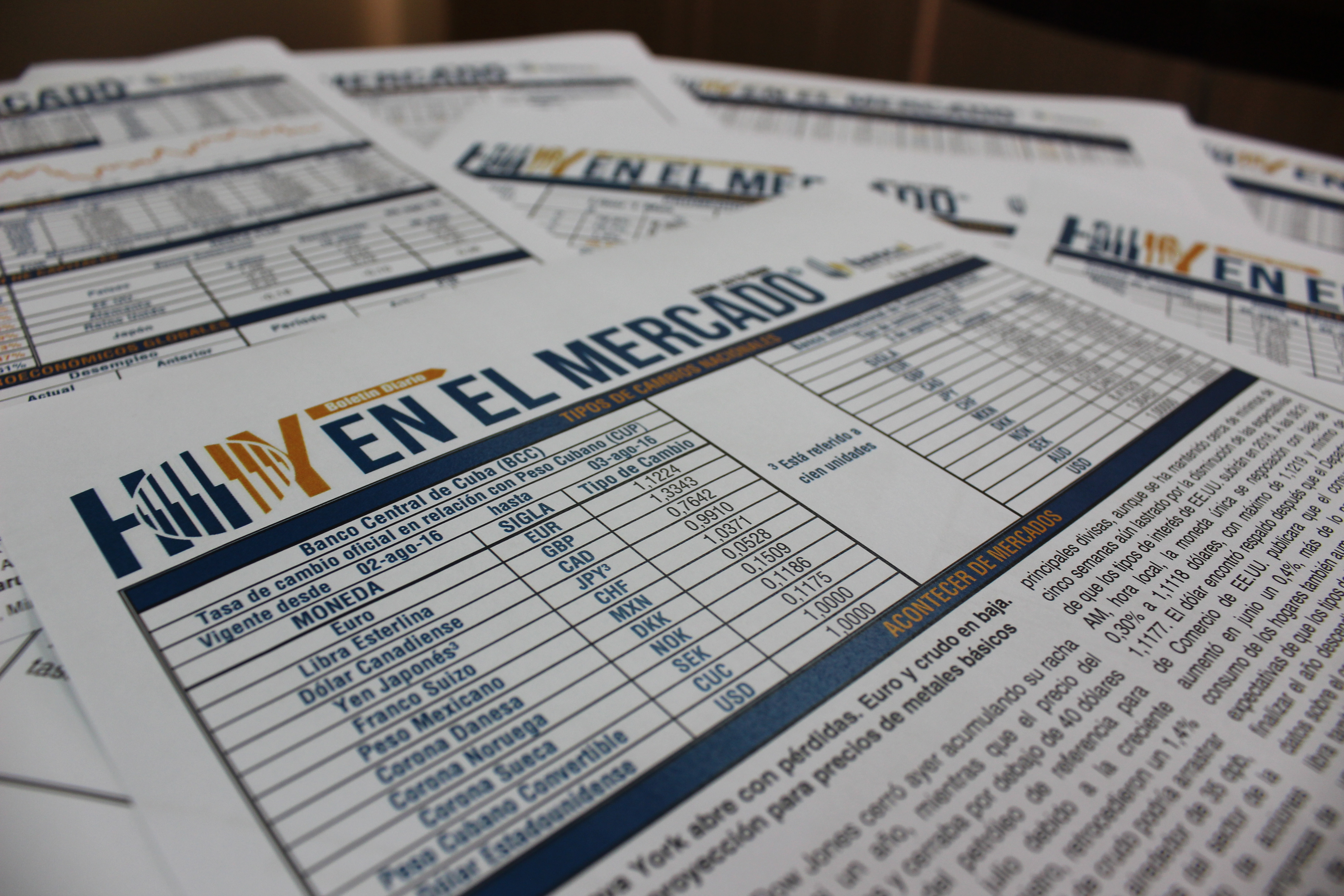

7- How can the Hoy en el Mercado Bulletins be requested?

R / The subscription to the HM publications can be requested through the form inserted in the Website, by e-mail This email address is being protected from spambots. You need JavaScript enabled to view it. or direct contact with the specialists of the Publications and Market Studies Management of Bancoi S.A. Your request will be answered immediately. The clarity, simplicity and speed of the necessary legal documentation is guaranteed.

8- By being subscribed to the Hoy en el Mercado publications will only the Daily Bulletin be received?

R / No. By being a Client of the Bulletin, you will receive a product with added value that complements in a package the Daily Bulletin, the Weekly Bulletin of Foreign Exchange, the Monthly Bulletin of Interest Rates, the Quarterly Country Risk Bulletin, the Annual Bulletin of Foreign Exchange and a Glossary of Terms, becoming the beneficiary of a vital information package for decision making in the Cuban company, through accessible prices and a unique service in Cuba, registered in the Cuban Agency ISBN with registration ISSN: 2413-9300.

9- What products or markets are contemplated as part of the Market Studies service offered by the Bank?

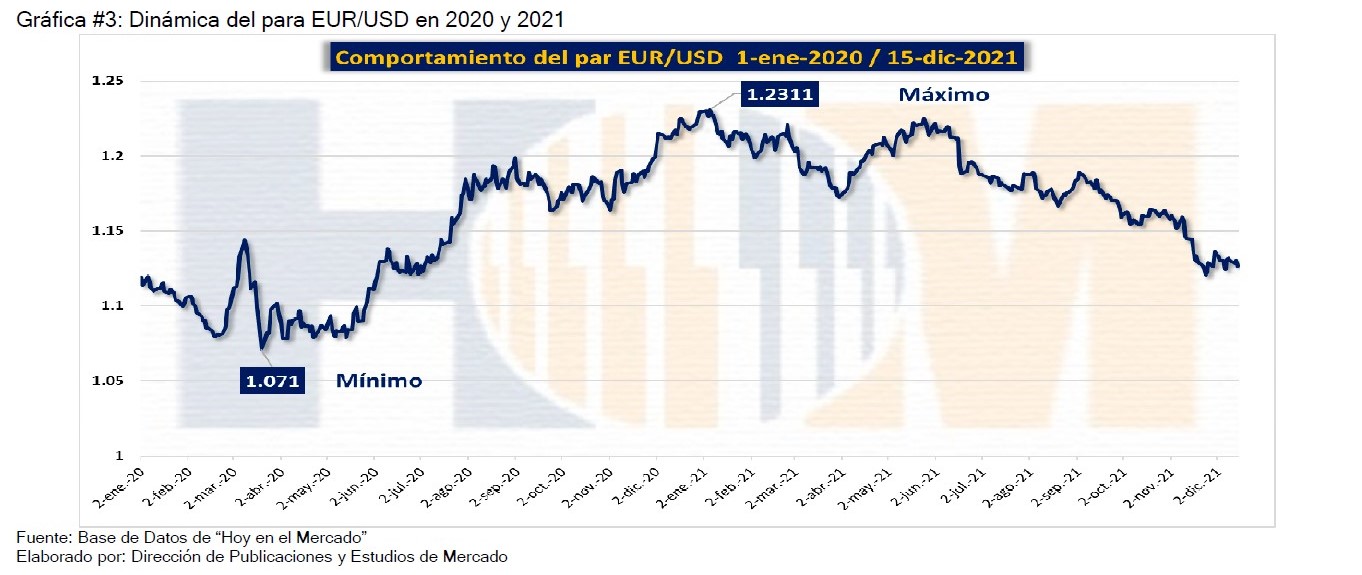

R / The Market Studies contemplate the analysis of the prices of the main products in the international market, according to the content of the Hoy en el Mercado Bulletins. Occasionally it may cover new products not included in the Bulletin, after analyzing the viability of the requested service.

GENERAL INFORMATION

Banco de Inversiones S.A. was founded by Decree No. 344 of February 14, 1996, issued by the Special Notary of the Ministry of Justice (MINJUS) of the Republic of Cuba. Back then it is authorized to operate as a banking institution through Resolution No. 23 of 1997, granted by the Central Bank of Cuba (BCC).

The institution arises in the middle of the process of modernization of the Cuban Banking System, as a Society constituted by shares, registered in the Central Register of Public Companies (Book 138, Folio 80), in the First Mercantile Register of Havana (Book 1192, Folio 80) and in the Register of Financial Institutions and Non-Financial Entities (Volume No. 2, Folio 03).

Initially, Bancoi was a member of the Nueva Banca Group. In its management trajectory highlights its participation as advisor and structurer in relevant projects of bond issue, purchase of shares, financing and debt restructurings, with important Cuban and foreign corporate clients, supported by leading European banks. Its history is also linked to its Bulletin "Hoy en el Mercado", unique for more than two decades serving the Cuban business community.

Twenty years after its creation and now with a license to operate by Resolution No. 27/2019 of BCC, Bancoi is the only Cuban bank specialized in investment banking, highlighting for the excellence of its services and its prestigious clients. It works on the plataform of an Integrated Management System and reinvents and modernizes itself through a process of updating its corporate visual identity.